by Dan George

There are two types of options, Calls and Puts. A Call Option permits the buying of an option, whereas a Put Option will permit the selling of an option.

Do you ever wonder how Options work, and why does it all sound “Greek” to you while other people are talking about Calls and Puts? First of all, Options are a very risky investment, and they are not suitable for everyone. Options could lose significant value in a very short period of time.

Now for everything in life, you have to learn and begin somewhere. But, it is good to understand upfront that Options are a definite high-risk, and a potential high-return type of investment.

When you buy Options, it gives you the right to buy or sell the underlying stocks. When you sell options, you have an obligation to buy or sell the underlying stocks.

To repeat what was already said above, there are two types of options, Calls and Puts.

When you buy Call Options, you have the right to buy the underlying stocks. For the seller, it creates an obligation to sell the underlying stocks, if the buyer wants to exercise his right.

When you buy Put Options, it gives you the right to sell the underlying stocks, and similarly the seller has an obligation to buy the underlying stocks, if the buyer wants to exercise his right.

Now, the above definitions are most likely confusing for someone trying to understand the basics. So, let’s dive into all the necessary details…

Why would someone want to buy Call Options or Put Options?

Options are the most innovative investment instrument ever invented. If you look at the stock prices today, there are a majority of good stocks which a normal individual investor can’t reasonably afford. The Options allow the investor a chance to invest in these stocks at lower prices, and many times at fraction of what the stock price is.

So, if you think a particular stock is currently trading at an attractive price, and it would go higher in the future, you can explore the possibility of buying Call Options for that stock.

Similarly, if you think a particular stock is trading at higher price, and it would go lower in the future, buying the Put Options for that stock should be explored. The cost of the Options is called a Premium.

Why would someone want to sell Call Options or Put Options?

Short answer, to earn the premium… If you hold some stocks, and you think the stock prices for the defined time-frame would remain the same, you can explore the possibility of selling the Call Options for a little higher price than the current price, and collect the premium.

This would be called Covered Call since you already own the stocks and would be able to sell it, if the buyer later wants to exercise his right to buy the stocks. If you didn’t own the stock while selling the Call Options, it would be called a Naked Call, this would be the riskiest of the Options.

Now, if you want to buy some stocks at a lower price than it is currently trading, but don’t think it would go down that much in a defined time-frame. you can explore the possibility of selling the Put Options at the lower Price, and collect the premium.

If the stock eventually goes down to that price within that time-frame, you would simply buy the stocks.

Those are the easiest to comprehend definitions and explanations.

Let’s use an example to make this clear, and learn some more terms associated with Options.

Let’s consider Microsoft (MSFT) stock, we’ll cover some hypothetical examples.

You should do proper research and analysis before deciding if a stock price would go higher or lower. Let’s consider that Microsoft is trading around the $27 range, you are bullish, and you think that the price would go significantly higher in the next 4 months. You could look at the Call Option prices and find a $30 Call Option for about $0.87 per share.

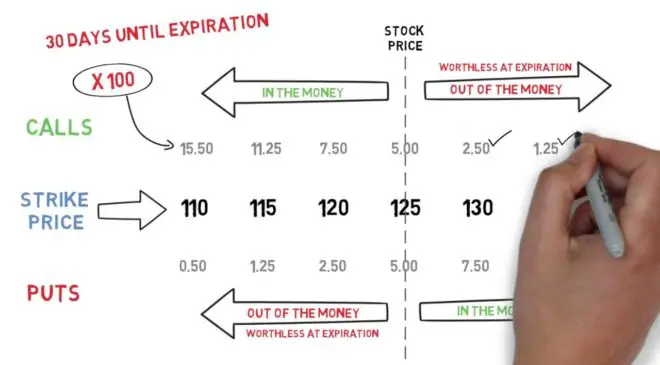

One contract option include 100 shares, so it would cost you $87. Here the $30 would be called Strike Price and $0.87 is the Premium. The premium for any Options gets determined from four main factors; Current Stock Price, Strike Price, Days to Expiration, and Implied Volatility.

The Options which expire further out would be more expensive, because of the time value associated. Also, the stocks with higher implied volatility would cost more. Now, for the example we are talking about, before the expiry date of Call Options, if and when the Microsoft stock trades above $30.00, the Option would be called ‘In the Money’.

If you are bearish about Microsoft stock, and think that it would go significantly lower in next 4 months, you could consider buying the Put Options of MSFT and find a $24 Put Option for about $0.85 per share. If by the expiry date of Put Options, the Microsoft stock trades below $24, the Option would be ‘In the Money’.

I would recommend setting an exit strategy on all Options trades, because the value changes very rapidly, and you could either quickly lose a lot of money, or you could quickly miss out on fast profits.

Learn how to invest, and also know your Investment Options.

Note: If you are an options trader, and you find anything in this article to be wrong, or you simply have a better explanation about options, leave your comment(s) below.

If you are not a pro or a guru yet; here are some highly recommended

legitimate resources which could be helpful to you... (A) learn to earn

(B) build business (C) earn your cash back (D) easy surveys for you

(E) everything you need to run your business for free