by Phyllis Espinoza

Falling into the trap of unmanageable debt is a very common situation. It is a proven fact that more than 45% of people in the USA spend more money than what they currently earn. Climbing out of the trap of debt could be a very complicated process without using the proper procedure.

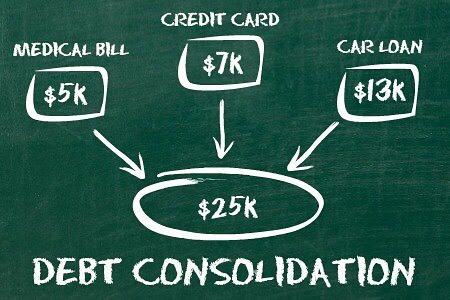

A proper debt consolidation plan is the real savior, because it can actually bring you out of that debt situation, and help you to clear or pay-off your loans at the same time.

WHAT IS DEBT CONSOLIDATION?

Generally, you will find that there are two types of debts, but each of them have different sub-categories. The objective is to secure one loan with a fixed interest rate, or lesser interest rate, to pay off all of your outstanding loans.

Below are explanations about the various types of loans, and the two forms of debt consolidation.

TRADITIONAL LOANS

Personal Loan – This type of loan is offered for a specific amount of money. A personal loan is given for declared and undeclared usage. This type of loan is processed through a bank, or another financial lending institute.

Secured loans are given to anyone against property or a guarantor, but unsecured loans are only provided to the consumers with a high credit rating.

Mortgage Loan – It is a long term loan issued specifically for purchasing personal or commercial property. As a customer, you might be able to negotiate down to a lower monthly payment.

Educational Loan – This type of loan is particularly designed for educational purposes only, for paying educational bills, meal plans, tuition fees, and other living expenses for college or university. This type of loan is paid after completing your course of study. With this type of loan, you can ask for an additional grace period.

Those (above) are the typical type of loans, and next we will explain about revolving credit.

REVOLVING CREDIT

Unlike traditional loans, revolving credit allows you to borrow the same amount of money again, after paying the current full loan amount. There are mainly two types of revolving credit that you will find in the marketplace: Credit Card and Line of Credit.

Credit Card – Today we all use plastic money. The credit card has become the most common form of personal debt. According to the latest surveys, it is said that most Americans have an average of five credit cards.

Line of Credit – Generally, a line of credit is issued by banks, and other financial organizations. It provides a reusable source of funds, and you can withdraw it by check or cash.

As previously mentioned above, one of the most practical ways to pay off your insurmountable debt is with debt consolidation. Usually, there are two types of debt consolidation, but it comes in one of two forms: Home Equity Loan and Negotiated Debt Settlement.

FORMS OF DEBT CONSOLIDATION

Home Equity Loan – This is one of the most effective debt consolidation solutions for mortgage customers, because it allows a customer to refinance their mortgage. The customer can use the equity amount that he built up as a loan guarantee, to pay off the higher interest loans, and credit card loans.

With the help of this home equity loan, homeowners pay one single payment per month, which is less than the total combined monthly loan amount of all the outstanding loans.

Negotiated Debt Settlement – This type of loan includes the involvement of a professional third party service which is specialized in debt consolidation. Usually, that third party will contact each of the creditors personally, on your behalf, and will negotiate an amount you have to pay every month.

The advantage of this sort of settlement is that the negotiated amount will always be less than the actual loan amount. All you have to do is pay the total negotiated monthly amount to the third party debt consolidator, and they will make the individual payments to each of your creditors.

PS: Getting into an appropriate debt consolidation plan will usually benefit the consumer in a favorable way, but a bad consolidation plan can lead to total disaster. Therefore, it is very important to research and know what a good debt consolidation plan has to offer.

As a consumer, you may not be so sure about all the guidelines of a good debt consolidation plan, so the seeking of professional advice can help you in a major way.

Phyllis Espinoza is a finance and financial debt writer who has also been in the business of buying mortgage notes, deeds of trust, and land contracts for over 15 years.

If you are not a pro or a guru yet; here are some highly recommended

legitimate resources which could be helpful to you... (A) learn to earn

(B) build business (C) earn your cash back (D) easy surveys for you

(E) everything you need to run your business for free