KnowHowToEarn.Com/Amazon || KnowHowToEarn.Com/Money

by Ryan O’donnell

What Is An Annuity?

~ An annuity is one of many tools available for retirement. It is technically an insurance based product, but can also be arranged and purchased through private financial institutions in addition to your insurance provider. It enables the bearer to maintain a steady income throughout retirement.

How Does It Work Exactly?

~ You purchase the annuity, and make payments. Payment amount and frequency are variable. When you retire, the annuity becomes your income source. The investment you’ve made in it becomes your income. Depending on your options, and how you’ve chosen to set up the annuity; your payments can be structured to be paid monthly, or to be paid in one lump sum.

Income For The Duration Of My Retirement Years?

~ You can receive payments for the rest of your life, or for a predetermined number of years. The amount paid to you depends on a number of factors; you may opt for a guaranteed payout amount, or a payout influenced by your annuity’s underlying investment performance.

How Many Types Of Annuities Are There?

~ There are essentially two types: immediate and deferred. The differences between them are as follows: (1) If you purchase an immediate annuity, you can begin receiving payments quickly after the initial investment. (2) If you opt for a deferred annuity, your money is invested for a set period of time, and withdrawals can be made at a later date (during your retirement years).

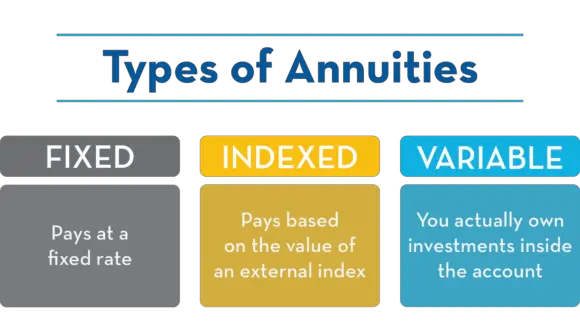

Annuities can also be categorized as fixed or variable, these distinctions are dependent on whether the payments are a fixed amount, linked to a group of investments, or even a combination of both of those factors (indexed annuity).

Fixed Annuity? | Variable Annuity?

~ With a fixed annuity, you aren’t responsible for the investments. The insurance company you purchased the annuity from will take care of that for you. The return is pre-determined beforehand. Conversely, a variable annuity allows you to choose how your money is invested in sub-accounts; therefore the value of your annuity is dependent on how your investments perform.

What Are The Benefits? | What About Taxes?

~ One of the biggest deciding factors to look at with an annuity is how much you’re able and willing to contribute to it. With an annuity, there is no cap or limit on how much funds you may contribute. To some, this makes it a more attractive option than an IRA or a 401k, both of which have limitations with regard to contribution amounts.

Here’s the best part: Money that you invest accumulates tax deferred. The amount you contribute is not taxed, but your earnings are taxed at your regular rate of income.

How Can I Be Sure An Annuity Is Right For Me?

~ If you have adequate funds, and have exhausted your options with traditional retirement strategies (IRA’s & 401k’s), the tax free growth of an annuity is a possibility to consider. Although, you must be willing to put money away for many years; which is a savings discipline that is not as easy as it may seem.

Also, you must understand that any payments made to you will be taxed as regular income, despite the fact that you may have owned the annuity, and contributed to it tax free for years.

Like any investment, whether it be related to retirement or not, you need to ask as many questions as possible with regard to the positives and negatives of the transaction. Carefully review the information you’ll be given, and if anything at all is unclear, or does not make sense to you, ask about it before committing to it.

An annuity just might be the perfect fit for your immediate and/or retirement plans. However, you must be able to learn, invest, manage, be consistent, and be patient.

You should compare competing fixed annuity rates to help figure out which one is best suited for your particular needs.

If you are not a pro or a guru yet; here are some highly recommended

legitimate resources which could be helpful to you... (A) learn to earn

(B) build business (C) earn your cash back (D) easy surveys for you

(E) everything you need to run your business for free