by Thomas Tuke

What is unclaimed money? Why is there unclaimed money? Unclaimed Money or Property encompasses any financial obligation that is due, and owed to another party (customer, vendor, employee, contributor, etc.). The key rule to remember is that this property never becomes the organization’s property – it always belongs to the person, or entity owed. Unfortunately, many organizations do not realize that uncashed checks, escrow balances, customer deposits, mysterious credits, unclaimed payroll, and insurance benefits, qualify as unclaimed property. These organizations are often referred to as the Holder of the abandoned money, or property.

1. Once the abandoned money, or property, is remitted to the State in which the Owner was last known to have resided, the “dormancy period” for that type of abandoned property starts. The typical dormancy period in most States is three to five years. That means that an organization can only keep those items on their books, and retain the associated funds for that period of time. Then, it must remit the funds to the appropriate State. Once the abandoned money reaches the State, the money, or property, is referred to as unclaimed.

2. A problem could be that the abandoned money, or property, is issued to a State in which the Owner has never lived. If the Holder of the abandoned money, or property, is headquartered in a different State, the abandoned money will be issued to that State. For example, many large publicly traded Companies with offices, or branches, throughout the country may be headquartered in Delaware.

3. Unfortunately, the laws governing unclaimed money and property are both complex, and it varies from State to State. It is complex for both the Owner of the unclaimed money, and the Holder of the abandoned money. Each state has its own set of laws. Even if you only have property to report to one state, many states require the filing of “negative” reports, meaning that it is your obligation as an organization to tell them you have nothing to report. But, you very likely will have liability to more than one state, each with its own dormancy periods, and rules on how to report the more than 100 different property types.

4. The format of the State’s unclaimed money database also varies widely:

• The fields of information or data points, are varied and not consistent; many States by law cannot display the actual dollar amount.

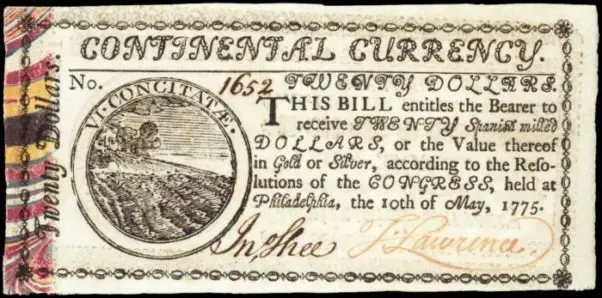

• If a dollar amount is displayed, and the amount is “$0.00” or “unknown”, that does NOT mean that there is no unclaimed money, but rather that the unclaimed property cannot be valued. An example would be if the unclaimed property is Stocks or Bonds whose value can change daily. Another example would be jewelry, or precious coins, found in an abandoned Bank Safety Deposit Box. The value of the coins are subject to change, depending on the circumstances.

5. One needs to be savvy while searching for possible unclaimed money, or property;

• Check any State in which one has resided

• Women should check their maiden, married, and divorced last names

• Never use a single apostrophe. i.e.) if last name is O’Brian, the last name search would be OBrian.

• A search for a Business with unclaimed money must be the Company’s exact name:

• The Auto Glass Co., not Auto Glass Company

• A & B Company, not A and B Company

• Check the common spellings of specific last names such as:

• Thompson, Thomson

• Smith, Smyth

• Robertson, Robinson

• Schmidt, Schmid, Schmit, Schmitt

• Barry, Berry

• O’Brian, O’Brien

6. Some States do not list the unclaimed money in their public database until 2 years after the lost property has been remitted to them. Most States’ Unclaimed Property Divisions are understaffed, so updating their databases can be delayed. Therefore, you should keep checking back regularly.

7. States are meant to be the Custodians of the unclaimed property. That means that they honor the Owner, or Claimant, or the heirs to the unclaimed asset for perpetuity. However, a few States have quietly passed laws by which if the unclaimed property is not claimed in 10 years, the property is reverted to the State as it’s property. Indiana, for example, is one of those States.

8. Although non-compliance was largely ignored in past years, the growth of state budget deficits that led by the current economic downturn, has brought the issue to the front burner. While most states have departments committed to returning unclaimed property to the actual owner, less than 30%, on average, is ever returned. So, 70% or more remains actively unclaimed, which allows cash-strapped states to use the money they collect as unclaimed property to fund various public interest projects.

The remainder is placed in a small reserve fund from which owner claims are paid. Therefore, unclaimed property represents, in essence, a “quiet” source of revenue that does not require the government to raise taxes. As a result, state enforcement efforts have steadily grown, and audits to drive compliance are at an all-time high.

9. Real estate, cars, boats, fixtures, and even animals that may be abandoned, but are not generally applicable to the unclaimed property statutes, are neither transferred to nor held in the State’s Unclaimed Property Division. The only tangible property that is transferred to the States, are the contents of a financial institution’s safe deposit box when the safe deposit box has been abandoned.

10. States aren’t the only ones holding onto unclaimed property. The Federal Government unclaimed money or property are:

• Federal Income Tax refunds

• FHA Mortgage Insurance premium refunds

• FDIC for failed Banks

• Unclaimed Pensions

• Lost Treasury Bonds

• American Indian Trust Royalties

• War Claims for US Nationals

If you are not a pro or a guru yet; here are some highly recommended

legitimate resources which could be helpful to you... (A) learn to earn

(B) build business (C) earn your cash back (D) easy surveys for you

(E) everything you need to run your business for free